Farm equipment depreciation calculator

Business use percentage if less than 100 depreciation method you want to use. Where D i is the depreciation in year i.

Appliance Depreciation Calculator

Deduction of 50 of the cost or opening adjustable value of an eligible asset on installation.

. It is a fundamental concept of business accounting. Enter the total federal minimum distribution allowance federal death. Because the irrigation system is used the MACRS class.

Salvage value is estimated to be 120000 37 100 44400. And if you want to calculate the depreciation youll also need to know the. If you are using the.

Under this method each item whether raised or purchased is valued at its market price less the direct cost of disposition. Use the Below Calculator to Check Your Tax Write Off. Existing depreciation rules apply to the balance of the assets cost.

Farm Machinery Cost Calculator. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and. The MACRS Depreciation Calculator uses the following basic formula.

Cost or adjusted tax value. Mandy operates a cut-flower farm. Lets say you bring in 12000 a year in rental income but have 4000 in operating expenses.

D i C R i. The annual depreciation is then. The annual depreciation comes off the top of your net operating income.

Use the drop-down list to choose the power unit or self. In June she purchased a used irrigation system for her flower beds at a cost of 15000. C is the original purchase price or basis of an asset.

The Section 179 Tax Deduction encourages agri businesses to stay competitive by purchasing shortline equipment which. The MACRS Depreciation Calculator uses the following basic formula. On the books depreciation is recorded as.

Depreciation limits on business vehicles. If the expected useful life is 10 years the salvage value factor is 37 as shown in Table 1. Enter the total amount of distribution subject to federal tax.

R i is the. D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is. Market price is the current price at the nearest.

Ordinary income and capital gain 1. Depreciation expresses the loss of value over time of fixed assets of a business. This tool allows you to calculate ownership and operating costs of common farm equipment.

Macrs Depreciation Calculator Based On Irs Publication 946

Pin On Agricultural Machinery

Types Of Accounts Accounting Simpler Enjoy It Learn Accounting Accounting Capital Account

What You Need To Know To Install A Culvert Culvert Drainage Solutions Installation

Methods Of Calculating Depreciation Accounting Simpler Enjoy It Method Calculator Accounting

Types Of Accounts Accounting Simpler Enjoy It Accounting Capital Account Loan Account

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Accelerated Depreciation And Machinery Purchases Farmdoc Daily

The Silver Lining To Used Equipment Prices Farming Organic Farm Farmers Farmersmarket Agriculture Ou Successful Farming American Agriculture Agriculture

Depreciating Farm Property With A 20 Year Recovery Period Center For Agricultural Law And Taxation

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

How To Calculate Depreciation Youtube

Depreciation Formula Calculate Depreciation Expense

Revaluation Method Of Calculating Depreciation Accounting Simpler Enjoy It Method Calculator Accounting

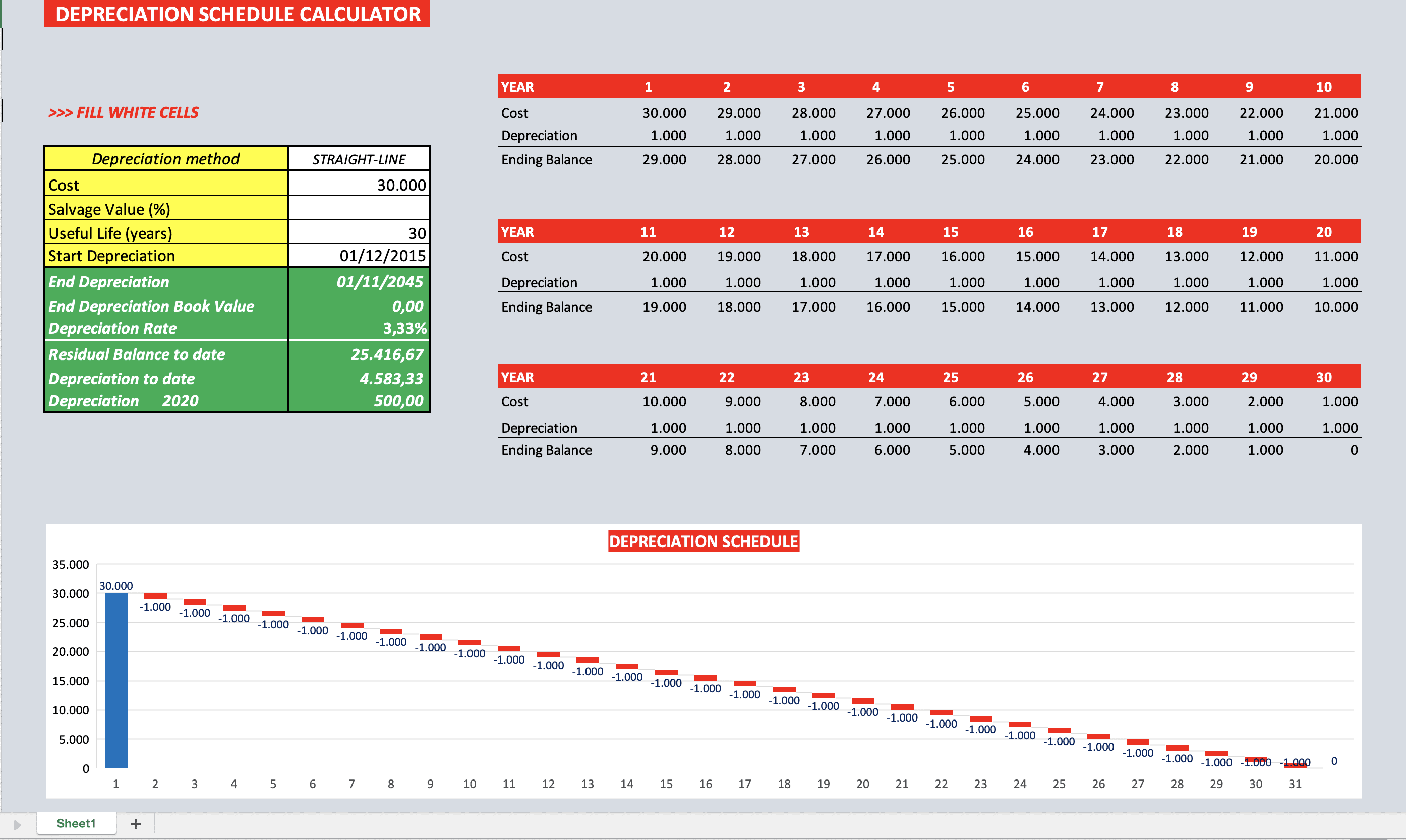

Depreciation Schedule Calculator Efinancialmodels

Depreciation Macrs Youtube

Depreciation Formula Calculate Depreciation Expense